AI-Powered Key Takeaways

Introduction

The finance industry is rapidly transforming with the rise of digital technology. However, legacy banking applications often encounter security, performance, and scalability challenges. Despite being essential for banking operations, these systems may struggle to integrate with modern performance testing tools, increasing the risk of issues like transaction omissions and data inconsistencies.

Efficient load testing is essential to assess the true capacity of banking applications, ensuring they perform optimally during peak demand. Performance testing is crucial in identifying vulnerabilities, such as memory issues, bandwidth limitations, and load balancing problems, which can lead to real-world failures. In the era of digital banking, effective performance testing is key to delivering a seamless customer experience and ensuring the success of banking apps.

This blog explores mobile banking performance benchmarking and its critical role in ensuring the efficiency and reliability of banking applications.

Different Types of Performance Testing for Banking Systems

To maintain reliable and efficient mobile banking applications, various types of performance testing come into play. These methodologies help identify bottlenecks, ensure scalability, and enhance overall system reliability.

- Load Testing: Load testing assesses how a system performs under expected user loads. It ensures the app can handle concurrent user activity, such as account logins, fund transfers, and balance inquiries, without slowdowns or failures.

- Stress Testing: Stress testing evaluates the app's stability beyond its peak load conditions by pushing the system to its breaking point. This reveals how the app handles extreme traffic spikes, ensuring preparedness for high-demand scenarios like promotional campaigns or payday rushes.

- Endurance Testing: Ensures the system can sustain continuous loads, as seen during high-demand times like bank closing days. This is done using benchmarks established during initial performance testing to gauge long-term stability.

- Volume Testing: Volume testing verifies the system’s ability to handle large volumes of data. For banking apps, this could involve processing massive amounts of transaction records or user data without degradation in performance.

- Scalability Testing: Assesses the application's ability to scale and adapt as the bank grows and its user base increases, ensuring the system remains efficient during periods of expansion.

- Spike Testing: Evaluates how the system responds to sudden spikes or drops in user load, such as during bill payment deadlines, ensuring the system remains stable during peak usage times.

By enhancing traditional tests with real-device testing, advanced monitoring, and AI-driven analytics, HeadSpin provides valuable insights into app behavior, network conditions, and device performance. Focusing on mobile banking performance benchmarks, these tests ensure the reliability, efficiency, and security of banking systems, improving user experience and preventing potential issues.

Optimal Timing for Performance Testing in Banking and Finance Apps

Timing is crucial for performance testing in mobile banking applications. These systems process numerous transactions daily, and performance extends beyond speed—it's about reliability, scalability, and efficient resource utilization.

Starting performance testing early in the development cycle is key to identifying and addressing issues from the outset. This approach goes beyond surface-level indicators like response time, focusing on uncovering and resolving underlying vulnerabilities.

Banking app testing typically centers on three core areas: the digital interface, core banking functionality, and overall banking operations. This holistic approach requires collaboration between business and quality analysts to ensure alignment with both technological and business objectives.

The golden rule for performance testing is to begin at the earliest feasible point, allowing for a thorough evaluation of bottlenecks and potential performance issues. Early testing ensures the entire banking system is optimized, delivering a robust, reliable, and efficient user experience.

How to Initiate Performance Testing for Banking and Finance Apps

Initiating performance testing for banking applications requires a structured strategy to ensure a smooth and successful process. A clear framework helps define timelines, allocate responsibilities, and estimate the project budget accurately. The steps in this process generally follow an agile development lifecycle, with adjustments based on the app’s scale, features, and business objectives.

- Requirement Gathering and Analysis

The testing process begins with gathering and analyzing requirements, covering both functional and non-functional aspects, such as speed, reliability, security, and availability. Domain knowledge and industry expertise are crucial to shaping a comprehensive testing approach. - Test Case Development

During this phase, testers create test cases and scripts based on identified requirements, ensuring all features are covered. Test cases should address functionality, user experience, load balancing, and security, with appropriate test data to support them. - Configuring the Test Environment

The test environment should closely replicate both internal bank systems and end-user conditions. This allows for assessing core banking issues and user experience from the customer's perspective. - Test Design Implementation

Test designs are created for both front-end and back-end sessions, ensuring a comprehensive assessment of the application’s performance. This approach helps identify potential bottlenecks, strengthen security, and validate the app’s functionality across different layers of its architecture. - Execution

Testers execute tests according to the approved strategy, identifying performance issues faced by customers and internal teams. This phase evaluates the app’s ability to handle stress and identifies system bottlenecks and weaknesses. - Analysis, Reporting, and Retesting

After tests are completed, the results are compiled into a comprehensive report. This report highlights issues, observations, and performance metrics and offers actionable recommendations for system optimization.

As the banking software landscape evolves, performance testing, including mobile banking benchmarks, remains essential for ensuring reliable, high-quality services. A strong testing strategy helps banks meet new trends and maintain an infrastructure that efficiently supports customer needs.

Key Tips for Ensuring High-Performance Mobile Banking Apps

Highly rated apps didn't achieve their success by chance; rigorous testing, including the assessment of mobile banking performance benchmarks, played a pivotal role. Consider these strategies to expedite your operations, yield quicker results, and bring thoroughly validated, optimally functioning software to market.

- Test on Real Devices: Always prioritize testing on real devices to simulate actual user experiences. Emulators and simulators can be helpful for initial testing, but they don't capture the performance nuances of physical devices.

- Cross-Device and Cross-Network Testing: Ensure your app performs well across a range of devices and network conditions. This includes testing under varying network speeds, such as 3G, 4G, and Wi-Fi, to identify potential bottlenecks.

- Load and Stress Testing: Simulate peak user loads and stress-test your app to identify its limits and ensure it can handle high traffic without crashing or slowing down.

- Continuous Monitoring: Implement ongoing performance monitoring post-deployment to detect any potential issues early. This ensures that the app maintains optimal performance even after updates or changes.

- Optimize Critical Features: Focus on optimizing the most frequently used and critical features of the app, ensuring they are fast, responsive, and reliable under all conditions.

Enhancing Financial Process Performance and Efficiency: HeadSpin's Advanced App Testing Solutions for Global Banking Organizations

1. Elevating Digital Experiences with AI ML

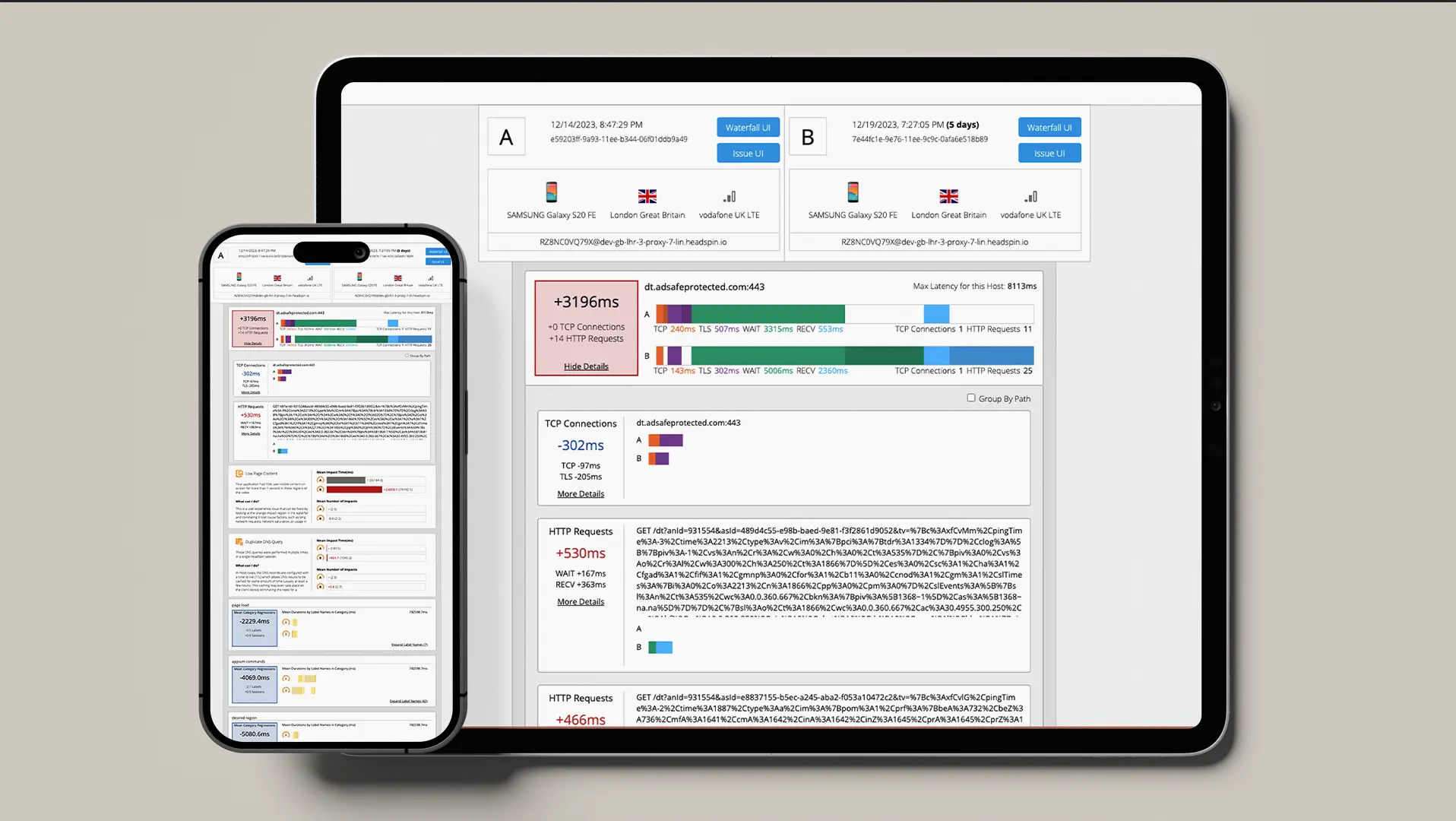

- Seamless Apps: HeadSpin leverages AI and ML technologies to enhance the performance of banking applications through comprehensive testing and performance insights. Our platform focuses on AI-driven analysis of user interfaces and app functionality, enabling businesses to optimize user experiences. By analyzing network data and device performance, we ensure seamless digital interactions and improved application reliability.

2. Swift Time-to-Market with Continuous Testing

- Efficient Development: HeadSpin's continuous testing solution significantly reduces QA time throughout the mobile banking app development lifecycle. Our rapid feedback mechanism accelerates testing processes, enabling smoother iterations and faster releases while maintaining high application quality and performance standards.

3. Proactive Error Detection via Root-Cause Analysis

- Error Prevention: HeadSpin empowers banks with root-cause analysis, identifying errors in apps and payment features. Proactive error handling reduces development costs and enhances the customer experience.

4. Secure Cloud Testing Solutions

- Enhanced Security: HeadSpin's global device infrastructure offers flexible options tailored to your security needs, from secure on-premise to private cloud. Our global device testing facilities enable remote testing, safeguarding your app's security.

Final Thoughts

Performance testing is critical in ensuring the reliability and efficiency of banking applications. Given the vast amounts of sensitive financial data these systems process, thorough testing is not optional—it is essential. A compromised testing process can jeopardize customers' financial assets and undermine trust in banking services.

At HeadSpin, we bring a wealth of expertise to testing banking applications. Our seasoned professionals possess the acumen to unearth underlying issues within banking and finance applications. Our mission is clear: to ensure these apps operate securely, reliably, and with peak efficiency.

FAQs

Q1. What is the role of Key Performance Indicators (KPIs) in assessing financial performance?

Ans: Key Performance Indicators (KPIs) play a crucial role in evaluating the performance of banking applications by measuring specific technical and user-centric metrics. Relevant KPIs include app uptime, transaction success rate, average response time, page load speed, and error rates. These indicators help banks ensure smooth digital transactions, maintain service reliability, and provide an optimal user experience. By regularly tracking these KPIs, financial institutions can identify performance bottlenecks, enhance system stability, and improve overall app functionality.

Q2. What Are Performance Bugs and Their Implications?

Ans: Performance bugs encompass issues related to the speed, stability, response time, and reactivity of software or applications. These bugs are typically discovered through performance testing and can substantially influence the user experience. They often lead to user frustration and hinder productivity.

.png)

-1280X720-Final-2.jpg)