AI-Powered Key Takeaways

The banking sector's era of long queues, mountains of paperwork, and manual processes is fading fast. Today, digital technologies are transforming how financial institutions operate. Intelligent Automation (IA) is a key disruptor among these transformative forces. By combining Robotic Process Automation (RPA) with advanced technologies like Artificial Intelligence (AI), machine learning, and data analytics, IA empowers banks to streamline operations, enhance efficiency, and deliver superior customer experiences.

Intelligent automation permeates every aspect of banking, from fraud detection and risk assessment to customer onboarding and personalized financial advice. By embracing these cutting-edge technologies, banks can improve efficiency and reduce costs, enhance customer satisfaction, gain a competitive edge, and thrive in an increasingly digitalized world.

Key technologies leveraged by intelligent automation

Intelligent Automation leverages a powerful combination of technologies, including Artificial Intelligence (AI), Robotic Process Automation (RPA), and Business Process Management (BPM). AI, with its machine learning capabilities, enables systems to analyze vast amounts of data, identify patterns, and make intelligent decisions. RPA automates repetitive tasks, freeing up human employees for more strategic work. BPM optimizes workflows, ensuring efficiency and consistency across the organization.

These technologies empower banks to streamline operations, improve customer experiences, and gain a competitive edge.

Why should businesses invest in Intelligent Automation?

For banks, investing in Intelligent Automation is no longer a choice but a necessity. Intelligent Automation addresses critical challenges such as:

- Increased competition: Disruptive fintech companies are constantly innovating. Intelligent Automation helps banks remain competitive by improving efficiency and offering personalized customer experiences.

- Regulatory compliance: The financial industry is heavily regulated. Intelligent Automation can help banks automate compliance checks, reducing the risk of errors and penalties.

- Data-driven decision-making: Intelligent Automation enables banks to leverage the power of data analytics to gain valuable insights into customer behavior, market trends, and risk factors.

- Enhanced customer experience: By automating routine tasks, banks can free up employees to focus on providing personalized and exceptional customer service.

Read: A Comprehensive Guide to Automated Software Testing

How HeadSpin helps improve Banking app experiences for end users

HeadSpin helps test banking applications more efficiently and effectively and obtain the best outcomes. The holistic capabilities enable banking and financial organizations to ensure customers' seamless digital user experience.

1. Global testing — HeadSpin helps run tests on multiple devices in various locations worldwide in real-world scenarios to deliver flawless user experiences.

2. Integrate CI/CD pipeline for automating testing — The HeadSpin data and analytics platform seamlessly integrates with various open test frameworks, enabling deep integration of HeadSpin sessions into the CI/CD build process. HeadSpin allows tagging each session with a build_id and enables viewing all the devices being used during a build. At the end of the build, statistics based on the HeadSpin performance data are also available.

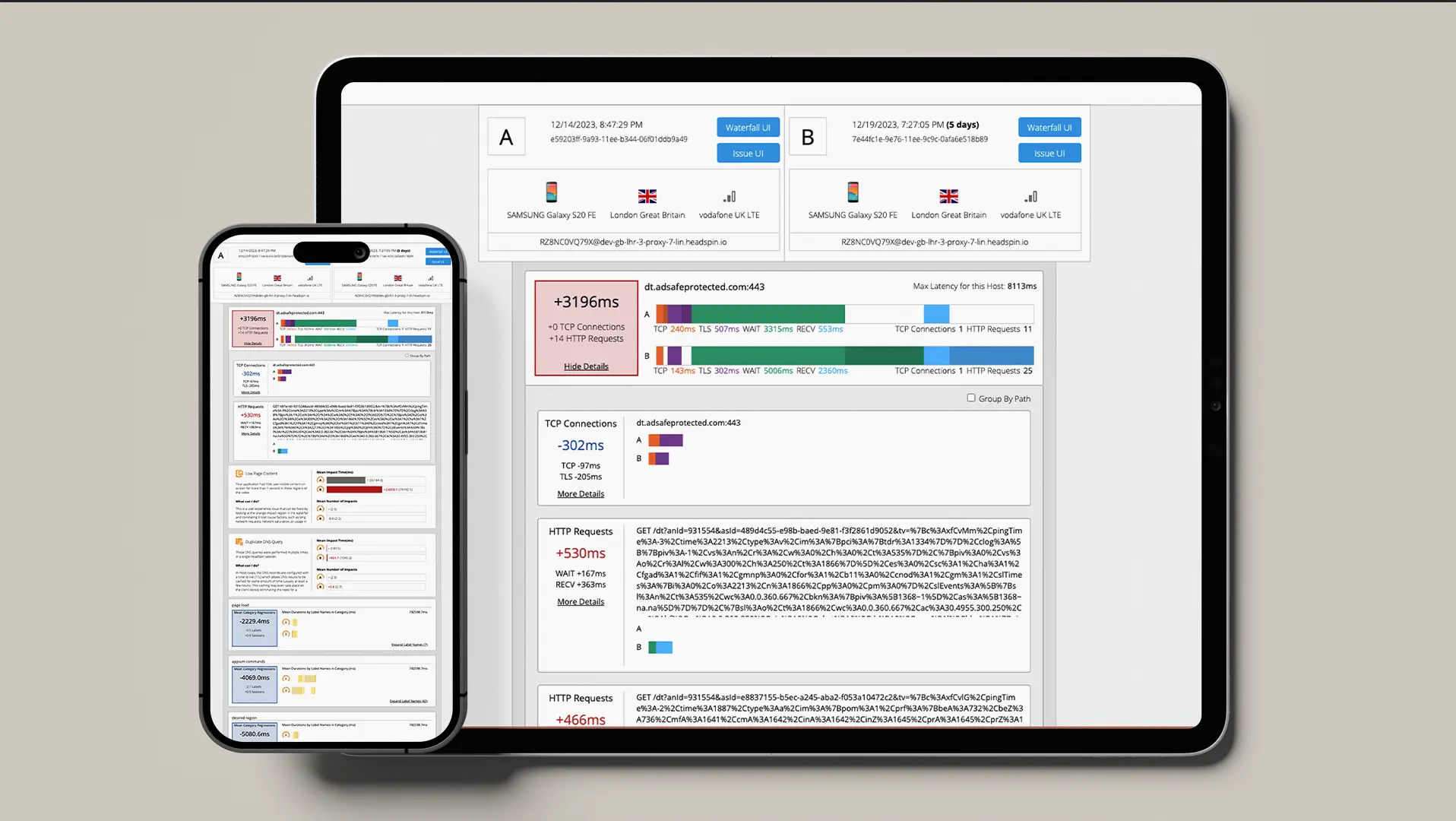

3. Obtain deep insights into app performance and user experience — The HeadSpin platform utilizes advanced data science to deliver AI-based insights into app performance. It measures and analyzes packet-level network data and several device KPIs through ML models and provides actionable insights.

4. Leverage regression intelligence — HeadSpin allows running build-over-build regression to identify performance regressions. Additionally, the platform helps compare performances across

- Different locations to better understand performance across different markets

- Different devices and OSs to understand cross-device/cross-OS compatibility and performance

- Different networks to understand network dependencies

5. Helpful data visualization dashboards (Grafana) and replica DB — HeadSpin data visualization helps users extract data across various sessions and obtain experience and performance insights from the data. Replica DB enables users to export test data to their dashboard solutions or data lakes. HeadSpin visualizations help configure alerts and watchers for continuous monitoring of KPIs.

.webp)

.webp)

.webp)

.webp)

6. Two-factor authentication (2FA) - HeadSpin enables organizations to replicate real user experiences by testing on actual devices, ensuring accurate validation. It streamlines 2FA workflows through automation, enhancing efficiency for regression and repetitive task testing. HeadSpin allows you to simulate diverse network conditions, including low bandwidth and high latency, and evaluates system performance in varying environments. It also monitors critical performance metrics such as response times, success rates, and error frequencies, identifying bottlenecks for improvement. Additionally, HeadSpin ensures compliance with industry security standards and best practices for data protection and user privacy.

Benefits of intelligent automation and how HeadSpin can help garner them across the Banking industry

Intelligent Automation empowers banks to revolutionize their operations by automating manual, data-intensive workflows. This accelerates business performance and efficiency and enables them to meet evolving customer demands by delivering personalized experiences and enhancing customer satisfaction.

- Monitoring end-to-end user journey — HeadSpin's solutions can align effectively to assist financial services companies in monitoring the end-to-end user journey from the time of order placement by a merchant to the completion of transactions on the client payment platform. HeadSpin's capabilities enable continuous monitoring of Client APIs consumed by the upstream apps and allow monitoring of the critical KPIs for user experience and performance. Further, the continuous monitoring and reporting capabilities allow the clients to ensure seamless end-consumer experiences by leveraging several customized KPIs, visualization dashboards, and intelligent alerting for proactive issue detection.

- Enhancing banking and financial compliance — As financial data proliferates in this space, it is essential to secure the processes, ensure safe transfers, processing, and data storage, and align with compliance regulations. Intelligent automation helps mitigate the risks related to data management and control processes more efficiently. It enables data control so that only the information required for each task is available. Thus, organizations can eliminate some primary risks associated with remote shared services and improve data security.

The PBox, a HeadSpin appliance, can be leveraged to test different apps on Android and iOS mobile phones, tablets, and other devices. The PBox can be securely deployed on the client's premises, and access devices and tests can be run through the HS remote Control UI. HeadSpin allows a security-sensitive deployment by deploying the appliance and devices into an isolated network managed entirely by the client where no traffic leaves the isolated network. HeadSpin's on-prem deployment also offers flexibility in specific locations like buildings, network end zones, and roaming.

- Enhanced Customer Experience:

- Intelligent Automation enables banks to personalize customer interactions, provide 24/7 support through chatbots, and offer tailored financial advice based on individual needs.

- HeadSpin helps ensure the seamless functioning of these digital channels by providing comprehensive testing and monitoring of mobile and web applications. This includes performance testing, user journey analysis, and real-time monitoring of key performance indicators (KPIs) to identify and resolve issues that could impact the customer experience.

- For a prominent client that uses a multi-channel login approach, allowing users to connect using phone banking, internet banking, and the bank's WhatsApp channel, HeadSpin created user journeys for every scenario and evaluated each separately.

- Improved testing pace and coverage:

- HeadSpin's holistic capabilities help improve automation coverage for new digital features and apps across various consumer devices. The open framework allows users to reuse existing frameworks and scripts without additional training.

- Further, HeadSpin offers crucial performance insights that help in the immediate identification and resolution of primary issues. HeadSpin's comprehensive solution has helped established legacy banks become leading digital banks, achieving:

.webp)

Also read: A Guide on Automated Mobile App Performance Testing (iOS and Android)

Flexible deployment modules provided by HeadSpin

HeadSpin puts forth several deployment models that help deliver the industry superior outcomes to its clients.

On-Prem (Client Premises)

HeadSpin can be deployed on-prem in an isolated network managed entirely by the client where no traffic leaves the isolated network.

Cloud (Single tenant)

This deployment model provides dedicated devices for clients in the HeadSpin cloud. Customer services, configurations, devices, and hosts are isolated to a private subnet, which enables testing normal app QA scenarios and analyzing apps in global locations through local teams.

Cloud (Multitenant)

HeadSpin provides access to shared devices deployed in the HeadSpin enterprise shared pool, which caters to sporadic testing and device-independent requirements.

Create Your Own Lab (Reverse Bridge)

The reverse bridge model (unique to HeadSpin) enables distributed testing from any location worldwide, with low-latency access to remote devices. This deployment model provides deep data and insights and helps manage user device QA.

Thereby, the comprehensive capabilities of HeadSpin help simplify software testing in the financial services, banking, and insurance sectors to help gauge the essential performances of customer-facing applications and employee apps and improve the overall processes.

How is HeadSpin different from many other competitive tools?

HeadSpin offers its holistic ML platform for testing and monitoring. It seamlessly supports multiple device types/forms, including low-, medium-, and high-end devices, to run end-to-end testing with faster execution. Unlike many competitor tools, which cannot capture device logs, the HeadSpin solution enables device, network, and automation logs to be captured in performance UI.

Other features:

- It offers audio-enabled and multi-gesture supported devices and automation for APIs for accessibility testing.

- Portability of existing automation scripts with no proprietary framework.

- Capability to automate Webview test cases.

Conclusion

In an era of rapid technological advancement, Intelligent Automation (IA) is no longer a luxury for the banking industry; it's a necessity. By embracing IA, banks can unlock significant operational efficiencies, enhance customer experiences, and gain a competitive edge. IA empowers banks to navigate the complexities of the modern financial landscape, from streamlining processes and reducing costs to improving fraud detection and personalizing customer interactions.

HeadSpin plays a crucial role in enabling banks to leverage the power of AI. Our comprehensive platform ensures the reliability and performance of the underlying technologies, allowing banks to maximize the benefits of automation while minimizing risks. By partnering with HeadSpin, banks can confidently embrace the future of finance, delivering innovative and seamless digital experiences to their customers and solidifying their position as leaders in the evolving financial landscape.

.png)

-1280X720-Final-2.jpg)